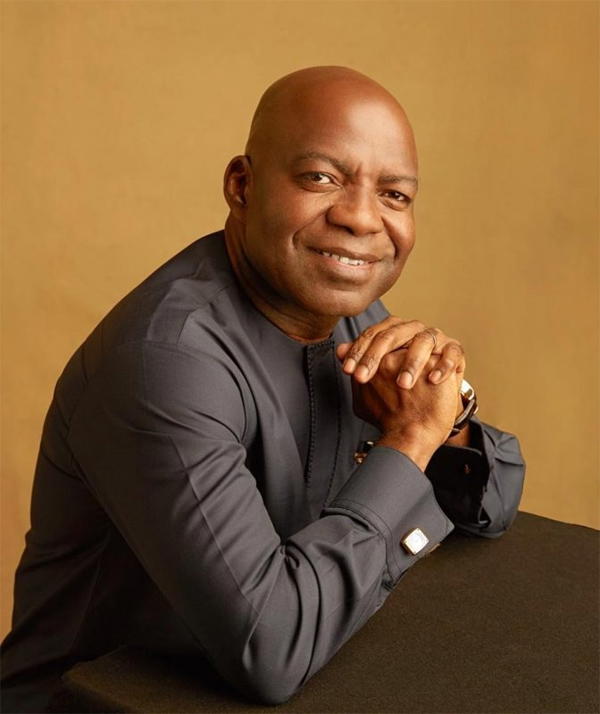

Unveiling Alex Otti's Net Worth 2024: What's Next? [Updated]

Is Alex Otti, the former Diamond Bank CEO and current prominent figure in Nigerian politics, truly a centimillionaire? Unveiling Alex Otti's Estimated Net Worth in 2024: Decoding the Finances of a Nigerian Powerhouse!

Alex Otti is a name synonymous with both the Nigerian banking sector and its burgeoning political landscape. He carved a significant niche as the Group Managing Director/CEO of Diamond Bank from 2011 to 2014, a period marked by both challenges and successes for the institution. Beyond banking, Otti is an entrepreneur, serving as the founder and chairman of the Board of Directors of Capacity Building International Limited, a consulting and training firm focusing on enhancing human capital. Recent estimates, circulating from various financial and news sources, place Otti's net worth in the neighborhood of $100 million as of 2023. This valuation considers a range of factors, most notably his established earnings from his long and impactful banking career, his diverse portfolio of business ventures, and strategic investments across multiple sectors.

The trajectory of Otti's wealth is deeply intertwined with his ascension in the banking industry. He didn't simply participate; he led, innovated, and navigated complex financial climates. These years of leadership have undeniably translated into substantial financial gains. Furthermore, Otti's strategic acumen extends beyond the boardroom. He has reportedly channeled considerable resources into tangible assets like real estate holdings, a mix of stocks spanning various industries, and other diverse investments designed to secure long-term growth. Complementing this financial prowess, Otti has cultivated a reputation for philanthropic endeavors. He's known to actively support educational programs aimed at bolstering literacy and skill development, as well as development initiatives designed to uplift communities throughout Nigeria.

- Hat Wentworth Miller Wirklich Eine Familie Das Steckt Dahinter

- Pltzlich Unerwartet Bobby Caldwell Todesursache Herzinfarkt Info

Looking ahead, the financial analysts predicting Otti's future trajectory largely concur: his net worth is poised for further expansion. This projected growth isn't based on speculation but rather on the anticipated outcomes of his ongoing business expansions and a portfolio of shrewd investments strategically positioned to capitalize on emerging market opportunities. His reputation as a successful entrepreneur isn't just a title; it's backed by a demonstrable track record. Ottis investment choices have historically yielded significant returns, solidifying his position as a keen financial mind.

| Full Name: | Alex Otti |

| Date of Birth: | March 25, 1964 |

| Place of Birth: | Umuahia, Abia State, Nigeria |

| Nationality: | Nigerian |

| Education: | University of Port Harcourt (B.Sc. Economics) |

| Career: | Banker, Economist, Politician |

| Net Worth: | $100 million (estimated) |

| Official Website: | alexotti.ng |

Alex Otti's financial story is inextricably linked to his distinguished tenure in the banking sector. His ascent to the position of Group Managing Director/CEO at Diamond Bank wasn't a matter of chance; it was the culmination of years of dedicated service, strategic acumen, and a deep understanding of the intricacies of finance. Holding such a pivotal leadership position invariably provided access to considerable financial resources and opportunities.

- Strategic Leadership: Otti's leadership philosophy extended beyond simply maintaining the status quo. He actively championed innovation, steered the bank through periods of economic volatility, and implemented strategic initiatives that ultimately contributed to its overall profitability and market position. His ability to make critical decisions under pressure and inspire confidence in his team were hallmarks of his leadership style.

- Investment Banking Expertise: Beyond the day-to-day operations of a commercial bank, Otti possessed considerable expertise in the realm of investment banking. This involved advising corporations on complex financial transactions, including mergers, acquisitions, and capital raising endeavors. These advisory roles often came with significant compensation packages, further contributing to his personal wealth.

- Commercial Banking Prowess: Otti's comprehensive understanding of commercial banking principles also played a vital role in his financial success. He oversaw the origination and management of a vast loan portfolio, ensuring that the bank's lending activities were both profitable and aligned with responsible risk management practices. His ability to identify creditworthy borrowers and structure loan agreements that benefited both the bank and its clients was a key factor in his success.

- Financial Advisory Services: In addition to his corporate roles, Otti has also provided financial advisory services to individuals and businesses. His expertise in financial planning, investment strategies, and wealth management has made him a sought-after advisor, further augmenting his income and solidifying his financial standing.

The substantial income generated throughout his banking career served as the bedrock for Otti's future financial endeavors. He didn't simply accumulate wealth; he strategically deployed it, recognizing the importance of diversification and long-term growth. These early earnings were channeled into a range of investments, including real estate holdings, equity positions in promising companies, and other assets designed to provide both income and capital appreciation.

- Entdecke Jessica Kirson Kids Mehr Als Nur Kinderkleidung

- Avm Saravanan Der Aufstieg Des Einzelhandelsknigs Sdindiens

Alex Otti's investment portfolio, a testament to his financial foresight, has been instrumental in propelling his net worth to an estimated $100 million by 2023. His strategic allocation of capital across diverse asset classes demonstrates a clear understanding of risk management and wealth preservation. While precise details of his holdings remain private, available information points to a well-balanced approach that has consistently yielded positive returns.

Real estate, in particular, appears to be a cornerstone of Otti's investment strategy. He reportedly owns a diverse portfolio of properties located both within Nigeria and abroad. These holdings likely include residential properties, commercial buildings, and potentially even land holdings ripe for future development. Real estate offers a unique combination of stability and potential appreciation, making it an attractive asset class for long-term wealth accumulation.

Beyond tangible assets, Otti has also demonstrated a keen interest in the stock market and other financial instruments. His equity investments likely span a range of industries, reflecting a diversified approach designed to mitigate risk. While the stock market can be volatile in the short term, historically, it has proven to be a powerful engine for wealth creation over the long haul.

However, astute investment decisions require more than just access to capital; they demand careful planning, diligent research, and a willingness to take calculated risks. Otti reportedly relies on a team of experienced financial professionals to assist him in managing his investments and making informed decisions. This collaborative approach ensures that his portfolio remains aligned with his long-term financial goals and risk tolerance.

The dividends generated by Otti's investments have provided him with a steady stream of passive income, allowing him to maintain his desired lifestyle and reinvest capital for further growth. This cycle of income generation and reinvestment is a hallmark of successful wealth accumulation.

Alex Otti's commitment to philanthropy extends beyond mere financial contributions; it reflects a deep-seated desire to effect positive change within Nigerian society. His philanthropic endeavors, focused primarily on education and community development, are not only laudable but also strategically aligned with his long-term vision for a more prosperous Nigeria.

While the immediate impact of philanthropy on net worth may not be directly quantifiable, there are several indirect ways in which these activities can contribute to long-term financial success.

- Tax Optimization: Charitable donations to registered and reputable organizations often qualify for tax deductions, reducing Otti's overall tax burden and freeing up capital for further investment. This isn't about avoiding taxes; it's about strategically managing them in a way that benefits both the individual and society.

- Enhanced Reputation and Goodwill: In the Nigerian business context, reputation is paramount. Otti's philanthropic activities have undoubtedly enhanced his public image, solidifying his position as a respected and socially responsible figure. This positive reputation can translate into increased business opportunities, stronger partnerships, and greater access to capital.

- Investing in Human Capital: Otti's focus on education and community development is, in essence, an investment in the future of Nigeria. By supporting initiatives that improve education, healthcare, and economic opportunities, he is contributing to the development of a more skilled, healthy, and productive workforce. This, in turn, can lead to greater economic growth and a more stable business environment, benefiting all stakeholders, including Otti himself.

The connection between Otti's business acumen and the potential growth of his net worth in 2024 hinges on his ability to continue identifying and capitalizing on emerging opportunities. His track record in the banking sector, coupled with his strategic investments across diverse industries, positions him well to navigate the complexities of the Nigerian economy and achieve further financial success.

Otti's involvement extends across a spectrum of sectors, including not only finance but also consulting and real estate. As the founder and chairman of Capacity Building International Limited, he's actively engaged in shaping human capital development within Nigeria. His significant stake in Diamond Bank, one of Nigeria's leading financial institutions, further underscores his influence in the banking sector. And his real estate holdings, spread both domestically and internationally, provide a tangible asset base that contributes to his overall net worth.

Looking ahead to 2024, Otti's continued pursuit of new business ventures and strategic investments is expected to drive further growth in his net worth. His keen understanding of market dynamics, combined with his access to capital and a network of influential contacts, positions him to take advantage of emerging opportunities in a rapidly evolving economic landscape.

Alex Otti's journey exemplifies the power of entrepreneurial vision and strategic investment. His accomplishments in the business world have directly translated into a substantial net worth, solidifying his position as one of Nigeria's most successful business leaders.

- Identifying Untapped Potential: Otti possesses a rare ability to identify untapped potential in various industries. He's not afraid to take calculated risks and invest in ventures that others may overlook. This entrepreneurial spirit has been a driving force behind his success.

- Strategic Capital Allocation: Otti's investment decisions are not based on whims or speculation. He carefully analyzes market trends, assesses risk factors, and seeks expert advice before committing capital. This disciplined approach has allowed him to generate consistent returns and build a substantial portfolio of assets.

- Deep Financial Knowledge: Otti's background in economics and banking provides him with a deep understanding of financial principles. He's able to analyze financial statements, assess investment opportunities, and make informed decisions that maximize returns.

- Effective Leadership and Management: Otti's success is not solely attributable to his financial acumen. He's also an effective leader and manager, capable of building and motivating teams to achieve ambitious goals. His ability to inspire confidence and delegate effectively has been crucial to the success of his various business ventures.

The positive ripple effect of Alex Otti's wealth extends far beyond his personal financial success. His investments and philanthropic activities have a tangible impact on the Nigerian economy and society.

Otti's diverse business interests, spanning real estate, banking, and consulting, create a multitude of employment opportunities for Nigerians. His companies provide not only jobs but also training and development programs, empowering individuals to build successful careers and contribute to the nation's economy.

Beyond job creation, Otti's investments in infrastructure projects, such as road construction and healthcare facilities, improve the quality of life for countless Nigerians. These projects provide access to essential services, stimulate economic activity, and contribute to the overall development of communities.

Otti's philanthropic endeavors, focused on education, healthcare, and youth empowerment, further amplify his positive impact on Nigerian society. His support for educational institutions, healthcare initiatives, and youth development programs helps to create a more skilled, healthy, and empowered population, paving the way for a brighter future.

The following section addresses frequently asked questions surrounding Alex Otti's estimated net worth in 2024.

Question 1: What is the most current estimate of Alex Otti's net worth as we approach 2024?

Answer: While a precise figure remains elusive due to the private nature of wealth management, informed estimates, based on available data and financial analysis, place Alex Otti's net worth in the vicinity of $100 million as of late 2023. Projections suggest potential growth throughout 2024, contingent on market conditions and the performance of his diverse investment portfolio.

Question 2: What are the primary drivers behind the accumulation of Alex Otti's wealth?

Answer: The accumulation of Otti's wealth is multifaceted, stemming from his leadership roles in the banking sector (most notably as Group Managing Director/CEO of Diamond Bank), strategic investments in a range of asset classes (including real estate and equities), and returns generated from his entrepreneurial ventures.

Question 3: Can you identify the key sources contributing to Alex Otti's annual income?

Answer: While the specifics of his income streams are confidential, likely contributors include returns on investments (dividends, capital gains, rental income), revenue generated from his business ventures (such as Capacity Building International Limited), and potential consulting fees or advisory income.

Question 4: In what ways does Alex Otti's financial standing influence the Nigerian economy?

Answer: Otti's influence on the Nigerian economy is substantial. His investments create jobs, stimulate economic activity, and contribute to infrastructure development. Furthermore, his philanthropic endeavors support education, healthcare, and other critical social programs.

Question 5: Could you describe the core elements of Alex Otti's investment philosophy?

Answer: Based on available information, Otti's investment philosophy appears to be characterized by diversification (across asset classes and industries), long-term perspective, and a focus on both income generation and capital appreciation. He also emphasizes the importance of risk management and seeks expert advice to inform his investment decisions.

Question 6: What are the central themes of Alex Otti's philanthropic work and charitable giving?

Answer: Otti's philanthropic interests are primarily focused on education (scholarships, infrastructure development for schools), healthcare (supporting hospitals and clinics), and youth empowerment (training programs, mentorship initiatives).

Moving Forward: To gain a more in-depth understanding of Alex Otti's specific business activities and charitable work, we invite you to explore the subsequent sections of this analysis.

Alex Otti's financial ascent offers a compelling blueprint for individuals striving to enhance their own financial well-being. His journey underscores the importance of strategic decision-making, disciplined execution, and a commitment to continuous learning. Consider these key principles inspired by his success:

Prioritize Financial Education: Invest time and effort in acquiring a solid understanding of financial concepts, investment options, and wealth management strategies. Knowledge is your most powerful tool for making informed decisions and achieving your financial goals.

Establish Clear and Measurable Goals: Define your short-term, medium-term, and long-term financial aspirations. Outline a detailed plan to achieve these objectives, taking into account your current income, expenses, risk tolerance, and time horizon.

Cultivate a Disciplined Investment Approach: Diversify your investment portfolio across a range of asset classes, such as stocks, bonds, real estate, and alternative investments. Conduct thorough research, seek guidance from qualified financial advisors, and maintain a long-term perspective.

Practice Prudent Debt Management: Minimize unnecessary debt and prioritize paying down high-interest obligations. Explore options such as debt consolidation or refinancing to reduce interest expenses and accelerate your debt repayment efforts.

Explore Opportunities for Passive Income: Identify and pursue avenues for generating passive income, such as rental properties, dividend-paying stocks, or online businesses. Passive income streams can supplement your active earnings and provide greater financial security.

Embrace the Power of Giving Back: Engage in philanthropic activities that resonate with your values and contribute to the well-being of others. Charitable giving can not only make a positive impact on society but also enhance your own sense of purpose and fulfillment.

Final Thoughts: Financial success is not a destination but rather an ongoing journey. It requires discipline, perseverance, and a willingness to adapt to changing circumstances. By embracing these principles and learning from the example of successful individuals like Alex Otti, you can pave the way for a brighter and more secure financial future.

Article Recommendations

- Entdecke Jessica Kirson Kids Mehr Als Nur Kinderkleidung

- Mamitha Baiju Gre Das Geheimnis Ihres Erfolgs Jetzt Entdecken

Detail Author:

- Name : Enola Nolan

- Username : rosanna.hills

- Email : rolfson.ara@gmail.com

- Birthdate : 1981-08-26

- Address : 131 Stroman Groves Hackettville, NH 04792

- Phone : (770) 374-4217

- Company : Cole, Quigley and Harber

- Job : Secretary

- Bio : Est sed quod qui minima dolores. Facilis odio porro reiciendis repellat. Totam fugiat quasi molestiae. Vel et nisi et est nemo. Voluptatem ullam suscipit hic a.

Socials

twitter:

- url : https://twitter.com/jasmin2293

- username : jasmin2293

- bio : Harum porro nemo doloremque repellendus. Voluptatem molestias quidem quidem quo dolores alias. Omnis quia ea deserunt quia nihil consequatur.

- followers : 2050

- following : 1492

linkedin:

- url : https://linkedin.com/in/littel1982

- username : littel1982

- bio : Doloribus iusto voluptates iure commodi.

- followers : 6938

- following : 1251

instagram:

- url : https://instagram.com/jasmin1850

- username : jasmin1850

- bio : Suscipit consectetur accusantium quia amet. At non corrupti nemo assumenda dolore.

- followers : 3239

- following : 1415

tiktok:

- url : https://tiktok.com/@jasmin3905

- username : jasmin3905

- bio : Modi maxime consequuntur harum rem voluptatem aspernatur.

- followers : 5842

- following : 2340

facebook:

- url : https://facebook.com/jasmin_official

- username : jasmin_official

- bio : Odit consequatur perspiciatis aut facilis. Soluta non placeat vel accusantium.

- followers : 3959

- following : 30