Unpacking The Surprising Benefits Of SaverUSA: Why It’s Worth Your Attention

Let’s be real here—saving money ain’t easy, especially in a world where every swipe of your card feels like a step backward. But what if I told you there’s a program out there designed to help you build your financial future without breaking a sweat? Enter SaverUSA, a game-changer for folks looking to boost their savings game. Whether you’re a first-time saver or a seasoned budget wizard, SaverUSA has something to offer. So, buckle up and let’s dive into the nitty-gritty of why this program is worth your time.

You might be wondering, “What exactly is SaverUSA?” Well, it’s not just another financial app or some fancy investment scheme. It’s a legit, government-backed initiative that helps everyday Americans grow their savings. Imagine having a little extra cushion in your bank account without the stress of figuring out how to get there. That’s the magic of SaverUSA.

Now, before we get into the juicy details, let me tell you why this matters. Financial stability isn’t just a buzzword—it’s a necessity. With the cost of living skyrocketing and unexpected expenses lurking around every corner, having a solid savings plan is more important than ever. And that’s where SaverUSA comes in, offering benefits that could make all the difference in your financial journey.

- Neue Infos Ist Kim So Hyun Wirklich Am Daten Gerchte

- Mike Faists Gre So Gro Ist Er Wirklich Seine Karriere

What Exactly is SaverUSA and Why Should You Care?

First things first, SaverUSA isn’t just another financial buzzword. It’s a real-deal program designed to help people like you and me save smarter, not harder. Think of it as a financial buddy that nudges you in the right direction without all the hassle. The program works by partnering with local organizations and employers to provide incentives for saving. Yep, you heard that right—there are actual perks for putting away a bit of your paycheck.

The Origins of SaverUSA: A Brief History

Let’s rewind a bit. SaverUSA didn’t just pop up overnight. It’s been around for years, quietly helping thousands of Americans build their savings. Back in the early 2000s, the idea was born from a simple yet powerful concept: if people are rewarded for saving, they’re more likely to stick with it. Fast forward to today, and the program has evolved into a powerhouse for financial empowerment.

Top Benefits of SaverUSA: Why It’s a No-Brainer

Alright, let’s cut to the chase. What makes SaverUSA so special? Here’s a quick rundown of the top benefits that make this program a must-know for anyone serious about their financial future.

- Kevin Durants Frau Wahrheit Amp Gerchte Um Kevin Durant Frau

- Entdecke Marvin Sapps Alter Alles Ber Wie Alt Ist Marvin Sapp Heute

- Matching Contributions: One of the biggest perks is the matching contributions. Depending on your situation, you could get up to a 50% match on your savings. That’s like getting free money for doing something you should already be doing.

- Financial Education: Saving isn’t just about putting money away—it’s about knowing how to manage it. SaverUSA offers resources and workshops to help you become a financial rockstar.

- Flexibility: Life happens, and sometimes you need to access your savings. SaverUSA understands that and offers flexible options so you’re not stuck in a rigid system.

How SaverUSA Supports Your Financial Goals

Let’s break it down further. SaverUSA isn’t just about saving for the sake of saving. It’s about setting and achieving real goals. Whether you’re saving for a down payment on a house, building an emergency fund, or planning for retirement, SaverUSA has tools to help you get there. Plus, the program is designed to fit your lifestyle, not the other way around.

Who Can Join SaverUSA?

Here’s the best part—SaverUSA isn’t exclusive. It’s open to just about anyone who wants to take control of their finances. Whether you’re a single parent, a college student, or a working professional, there’s a spot for you. The program is particularly beneficial for low- to moderate-income individuals, but anyone can benefit from its resources and incentives.

Eligibility Requirements: The Fine Print

Of course, there are a few guidelines to follow. To be eligible, you’ll need to meet certain income requirements and commit to saving regularly. But don’t let that scare you off—SaverUSA makes it easy to get started. Plus, the rewards far outweigh the effort.

How Does SaverUSA Work?

So, how does this magical program actually work? It’s simpler than you might think. Once you sign up, you’ll set up a savings account through one of SaverUSA’s partner organizations. From there, you’ll start making regular contributions. The program tracks your progress and, depending on your situation, provides matching funds or other incentives.

Step-by-Step Guide to Getting Started

Here’s a quick step-by-step guide to help you get rolling:

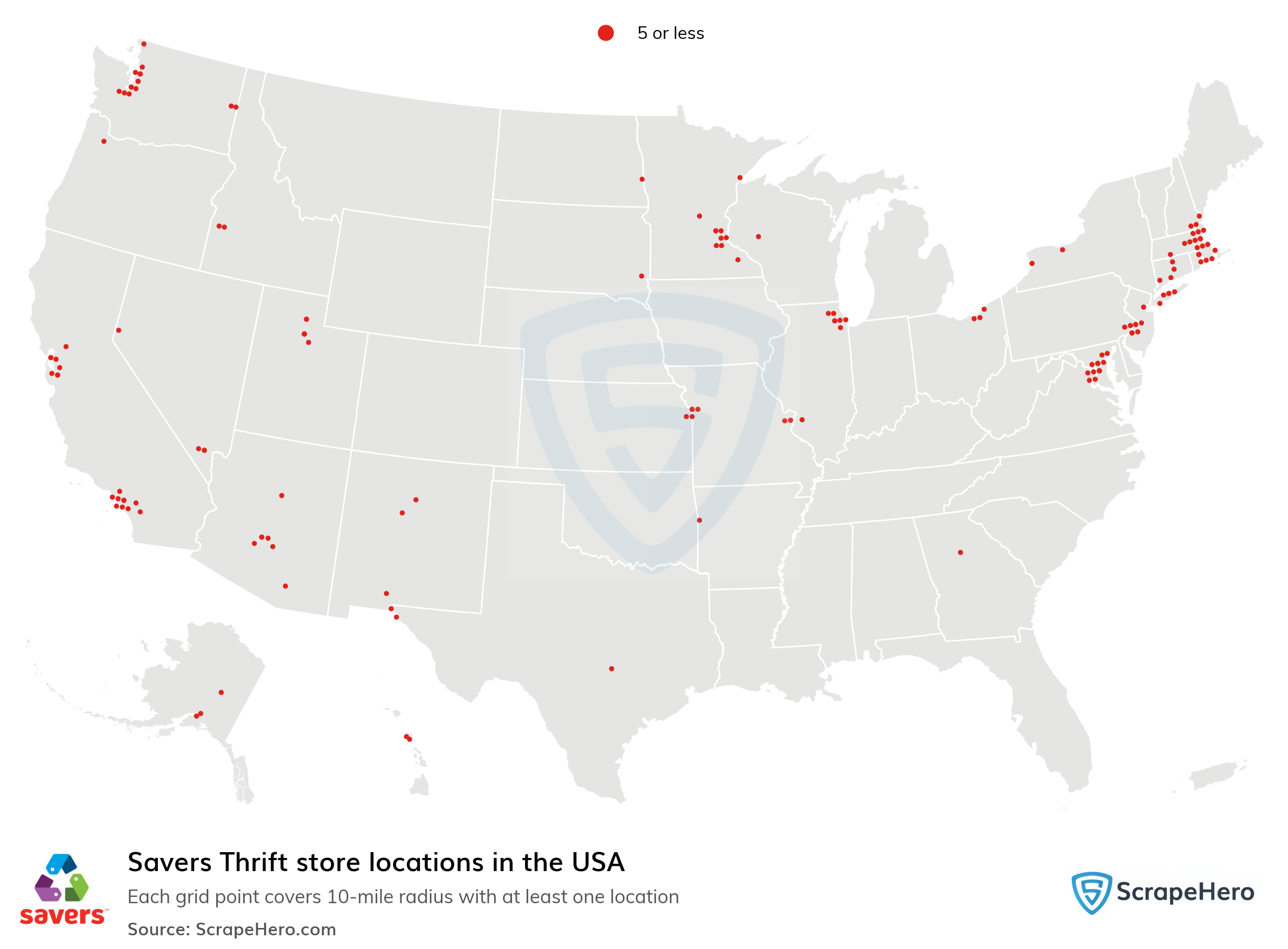

- Find a local SaverUSA partner near you.

- Sign up and open a savings account.

- Set your savings goals and start contributing.

- Reap the benefits of matching contributions and financial education.

Success Stories: Real People, Real Results

Don’t just take my word for it. Let’s hear from some real folks who’ve seen the benefits of SaverUSA firsthand. Take Sarah, a single mom from Ohio. She joined the program to save for her kids’ college funds. Within two years, she’d saved enough to cover a significant portion of their tuition. Or consider Mark, a factory worker from Michigan. He used SaverUSA to build an emergency fund that saved him during a tough patch at work.

Why These Stories Matter

These aren’t just feel-good tales—they’re proof that SaverUSA works. By providing real incentives and support, the program helps people achieve their financial dreams. And that’s what it’s all about—empowering everyday Americans to take control of their money.

Common Misconceptions About SaverUSA

Like any program, there are myths floating around about SaverUSA. Let’s bust a few of them:

- It’s Only for Low-Income Individuals: While it’s true that SaverUSA is particularly beneficial for those with lower incomes, anyone can join and benefit from its resources.

- It’s Complicated: Nope. SaverUSA is designed to be user-friendly and accessible for everyone.

- You Can’t Access Your Savings: Wrong again. SaverUSA offers flexible options so you can access your funds when you need them.

Clearing the Air: What SaverUSA Really Offers

By addressing these misconceptions, we can see that SaverUSA is a powerful tool for anyone looking to improve their financial situation. It’s not just for a specific group—it’s for anyone willing to take the first step toward financial independence.

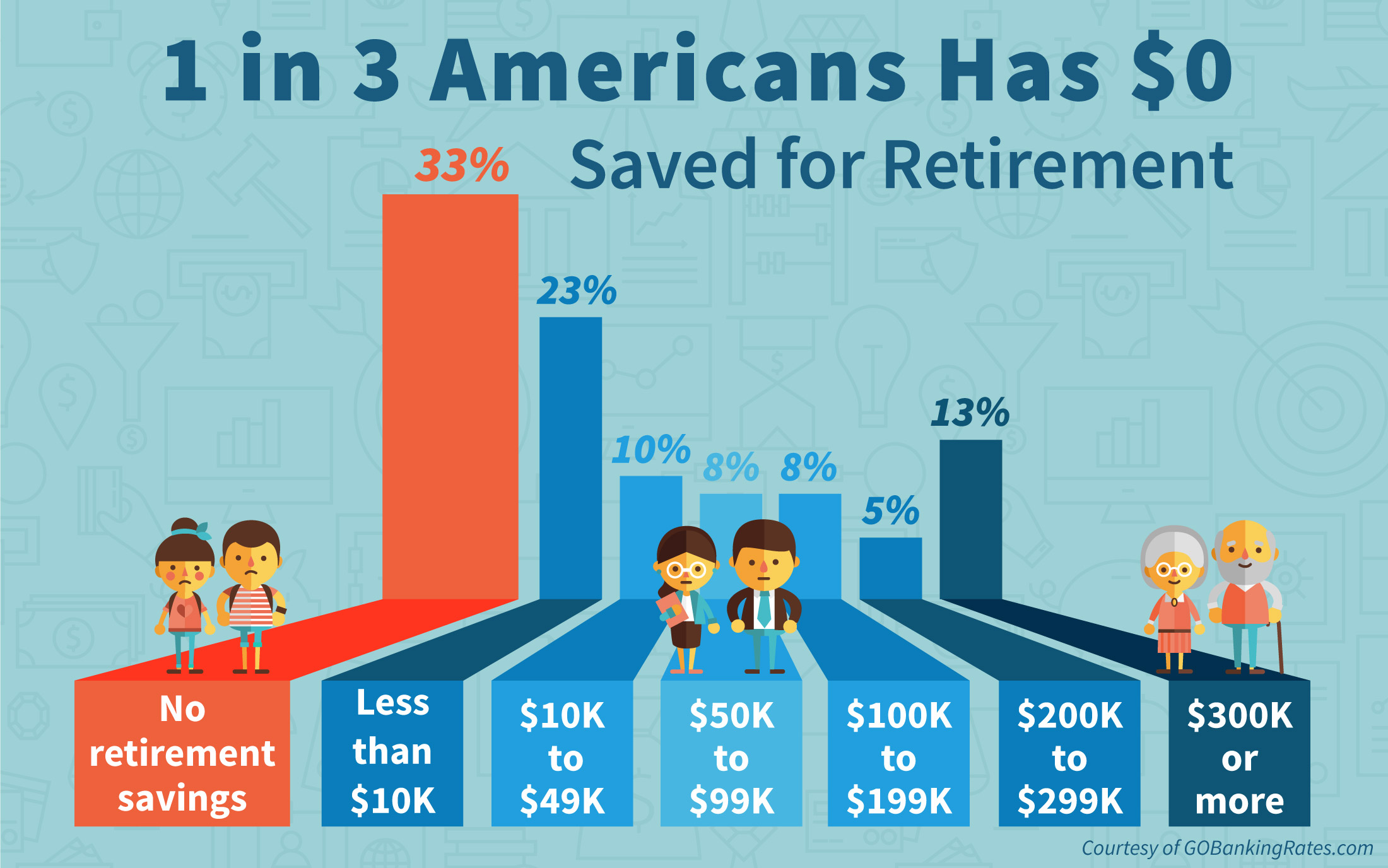

Expert Insights: What the Numbers Say

Let’s talk stats. According to a recent study, participants in SaverUSA programs increased their savings by an average of 40%. That’s a game-changer for anyone struggling to build a financial safety net. Plus, the program has a retention rate of over 80%, meaning most people stick with it long enough to see real results.

Where to Find More Information

Ready to learn more? Head over to SaverUSA’s official website or reach out to a local partner organization. They’ve got all the info you need to get started, plus tons of resources to keep you on track.

Final Thoughts: Why SaverUSA Matters

So, there you have it—the lowdown on SaverUSA and why it’s worth your time. Whether you’re just starting out or looking to level up your savings game, this program offers real benefits that can make a difference. Don’t let financial stress hold you back—take the first step toward a brighter future with SaverUSA.

Now, here’s the deal. If you’ve made it this far, you’re clearly interested in improving your financial situation. So, why not take action? Sign up for SaverUSA, share this article with a friend, or leave a comment below with your thoughts. Let’s make financial empowerment a reality for everyone.

Table of Contents

- Introduction

- What Exactly is SaverUSA and Why Should You Care?

- Top Benefits of SaverUSA: Why It’s a No-Brainer

- Who Can Join SaverUSA?

- How Does SaverUSA Work?

- Success Stories: Real People, Real Results

- Common Misconceptions About SaverUSA

- Expert Insights: What the Numbers Say

- Final Thoughts: Why SaverUSA Matters

Article Recommendations

- Enthllt Bryce Dallas Howard Verheiratet Alles Ber Ihre Ehe

- Kevin Durants Frau Wahrheit Amp Gerchte Um Kevin Durant Frau

Detail Author:

- Name : Bennie Terry I

- Username : ctillman

- Email : bednar.monserrat@hotmail.com

- Birthdate : 2007-04-08

- Address : 2957 Okuneva Loaf Apt. 889 Lake Alysa, AK 15775-2910

- Phone : 870-939-2398

- Company : Johnson-Franecki

- Job : Pewter Caster

- Bio : Est doloribus id sit tempore voluptas. Tempora iste omnis dolor sit consectetur. Explicabo quam aut sit. A id nulla commodi facere corrupti eveniet. Sit deserunt voluptas et cum.

Socials

facebook:

- url : https://facebook.com/vonrueden2005

- username : vonrueden2005

- bio : Molestiae sit eos facilis ut aliquam sit ducimus.

- followers : 6346

- following : 1174

tiktok:

- url : https://tiktok.com/@dejon3013

- username : dejon3013

- bio : Illo et consequatur voluptatem asperiores. Similique esse ratione fuga nobis.

- followers : 4372

- following : 2915

linkedin:

- url : https://linkedin.com/in/dejon.vonrueden

- username : dejon.vonrueden

- bio : Qui non aut iusto autem in.

- followers : 5823

- following : 1069

twitter:

- url : https://twitter.com/vonrueden2020

- username : vonrueden2020

- bio : Eius sint harum beatae qui ut. Suscipit aliquam in rerum aut nam. Perferendis quia esse tenetur nihil minima. Libero ut itaque quasi ut.

- followers : 500

- following : 2475